Mortgages are becoming more expensive in the Czech Republic. After record-breaking months for the Czech mortgage market, interest rates leapt by more than they have done in the last three years in July, and it is thought further increases are still to come.

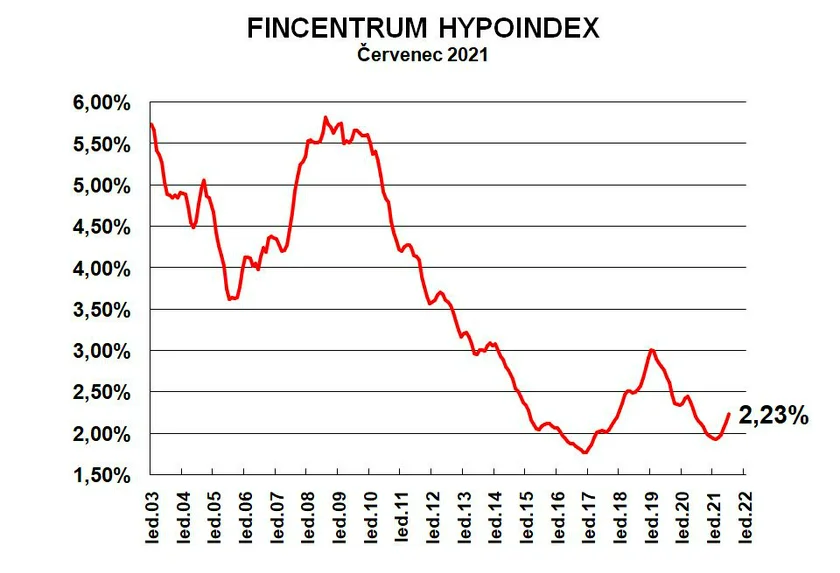

According to data from Fincentrum Hypoindex, mortgage interest rates increased by 10 points to 2.23 percent in July, the largest increase in the average rate since December 2018. Analysts suggest the hike in mortgage interest rates comes as a result of measures taken by the Czech National Bank (CNB) to combat inflation. The CNB has raised the base interest rate twice already this year, now standing at 0.75 percent.

“Due to strong inflationary pressures on the economy, the Bank Board can be expected to raise interest rates at least once or twice before the end of this year,” said Štěpán Křeček, chief economist at BH Securities.

Experts predict mortgage rates will continue to increase in line with base rates, with a likelihood that many could soon approach interest rates of 3 percent. With the CNB also increasing the price of housing loans, it is thought the record recent interest in mortgages may soon start to decline. Data suggests demand for mortgages was already on the wane in July, with banks reporting 10,967 arranged mortgages worth a total of CZK 35.3 billion, a decrease of 9.5 billion crowns on the record set in March this year.

“Although the volume of mortgages provided is already slowing down, we can safely say that this year will be a record year. The mortgage market has already surpassed the previous record set last year,” said Jiři Sýkora, mortgage analyst at Fincentrum & Swiss Life Select.

While the extraordinarily high demand for mortgages seen in the spring is now regarded as a temporary, unsustainable phenomenon, it is thought constantly rising real estate costs are also helping drive up mortgage rates. Another factor driving up prices is believed to be the cost of building materials, which is deterring many people and companies from construction plans which would help to meet demand for real estate.

“In addition to rising interest rates and real estate prices, the development of building material prices may also be crucial for the further development of mortgage demand. If prices continue to rise, a large people may back out from their plans to build,” said Vojtěch Prokop from the Zaloto mortgage broker.

In this context, it is thought demand is likely to rise the fastest for smaller properties, meaning the prices of smaller flats are likely to increase more quickly than other types of property. Such an increase would reflect rising consumer prices, which were 3.4 percent higher in July than they were the previous year, as inflation continues to exceed previous predictions.

Reading time: 2 minutes

Reading time: 2 minutes