Czechia’s digitization efforts have come a long way, but the old trope still remains: the country’s bureaucratic system isn’t for the faint of heart. Take-home pay feels like a riddle, freelancer taxes come with surprise plot twists, and most documents require a level of Czech even Google Translate has a hard time with.

It’s pain points like these that inspired the founding of Pexpats, a one-stop tax and visa agency offering services that support expats in Czechia. The company is legally licensed to operate in the Czech Republic and delivers its services fully online, without in-person visits or Czech-language paperwork.

Created by expats themselves, the team developed several online tools that directly address some of the hardest-to-navigate expat issues: salary and tax calculations, invoice generators, and more.

The resources are available in English, updated regularly, align with changes to Czech legislation, and best of all, they’re completely free. Here are a few you can start using today.

Calculate your net salary

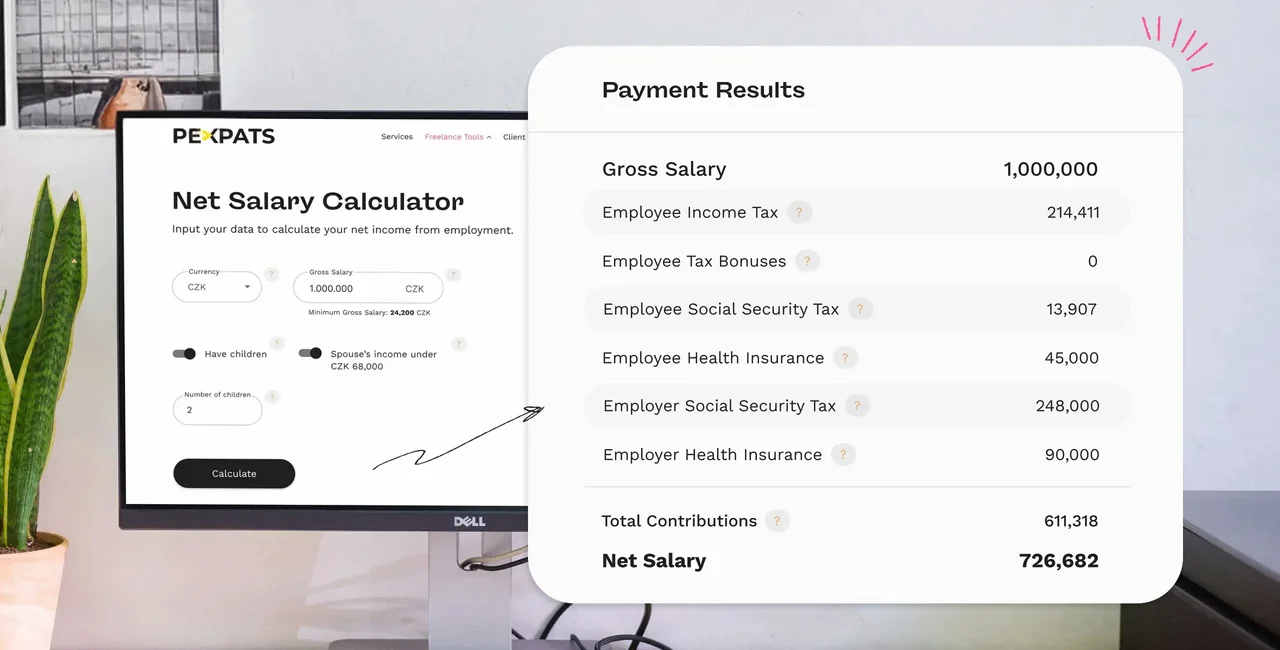

Czech employers almost always quote gross salary, leaving newcomers unsure of their actual take-home pay. This becomes especially complicated when considering spousal tax discounts, insurance, employer contributions, child bonuses, and other applicable bonuses. To clarify take-home pay, the Pexpats Net Salary Calculator converts gross salary into net income and deductions.

The tool caters to a person’s exact life situation, giving a clear picture of how much they’ll take home after everything is considered. The result includes net salary, income tax, employer costs, and all mandatory employee social-security and health-insurance contributions, with a clear picture of how much take-home pay you get to use otherwise.

Estimate trade license contributions

For self-employed workers (mainly those on a živnostenský list), the Pexpats Czech Trade License Tax Calculator estimates expected income tax and insurance payments under Czech OSVČ rules. Different rules apply based on your situation, so this free calculator provides an overview of potential Czech OSVČ taxes, including income tax, social security, and health insurance.

Users typically fall into one of three separate categories: those who are full-time freelancers, those who are employees earning side income via a trade license, and those filing a student income tax return or maternity income tax return. The tool is regularly updated and designed for planning purposes rather than exact guarantees, giving freelancers especially a realistic picture of obligations before filing or setting aside funds.

Generate invoices and paperwork

“Does anyone have an invoice template?” is a common query many freelancers in Czechia post in Facebook groups, hoping someone can help them navigate this crucial documentation. These folks can use the Pexpats Invoice Generator to create Czech-compliant invoices that meet local legal requirements. Customization options cover multiple languages and currencies, and areas like exchange rate text or Czech-required fields are auto-filled. Those with regular contracts can easily save client and banking information, service lists, and manage their inflows from a free account.

Because Czech authorities and business partners require paperwork in precise formats, any errors or missing documents can delay payments, tax filings, or visa and residency applications, with potentially serious implications. Pexpats also offers an English-language application form generator that guides users through official Ministry of Interior temporary residency forms and produces the completed Czech document online.

Another useful paperwork timesaver is their tax refund document generator, which creates a legal document of declaration for Czech tax authorities to claim tax deductibles for marriage status or child-rearing.

Prepare proof of accommodation and business address forms

Visa and residency applications often hinge on documentation, which is where the Pexpats Proof of Accommodation tool comes in. Typically, a form is needed to prove you reside where you say you're living, and if you're applying for an entrepreneurship visa, that your business is registered at a real address.

This tool assists with the much-needed forms, providing consent documents based on different property ownership types. The landlord or accommodation provider selects the relevant ownership category, completes the form online, and generates the required document. These forms need to be signed by the property owners and notarized to make it official with the Ministry of Interior.

Quick calculators for everyday checks

Sometimes expats simply want to sense-check a scenario before contacting an employer, bank, or authority. For fast reality checks, Pexpats offers tools that answer common questions without a full tax model.

Pexpats provides free calculators for employee tax refund eligibility, paid holiday entitlement, and monthly mortgage repayments. Used together, these quick tools help expats understand their position and avoid surprises in routine planning.

Demystifying confusing aspects of life in Czechia

All of these free tools made and maintained by Pexpats, a Czech-registered company operating since 2013, reflect current Czech law and tax rules.

They are most helpful when evaluating a job offer, starting freelance work, preparing annual taxes, or assembling documents for visas and residency. In each case, the focus is practical: clarity, accuracy, and fewer headaches.

Reading time: 4 minutes

Reading time: 4 minutes