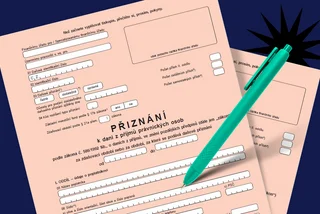

5 typical tax mistakes expats make in Czechia, and how to avoid them

Working out taxes in a foreign country is tricky, and innocent slip-ups can be extremely costly. An expert helps demystify Czechia’s tax system.

Will Czechia's incoming government put more money in freelancers' pockets?

The ANO-led government has long pledged to protect self-employed people and small businesses, though future pensions may be at risk.

ASK AN EXPERT: Can expats in Czechia save money under America’s new tax law?

A Prague-based wealth manager breaks down what’s changed, from income exclusions to cross-border money transfers, and how expats can benefit.

Self-employment insurance in Czechia: What changes in 2026

The majority of people with a trade license are expected to pay thousands of crowns more annually, but some people will be exempt.

A better deal? How some Czech freelancers may benefit from historic tax reform

Economists say that a change to the amount of flat-rate expenses freelances can deduct will level the playing field—though not everyone would benefit.

How to find the best tax experts and accountants in Czechia: A guide for expats

Simplify tax season with expert guidance on personal finance and filings, VAT, business taxes, and double taxation in Czechia.

Everything you need to know before filing your Czech tax return in 2025

From what documents you need to how to avoid double taxation, TMF Group offers tips for making the process easier for expats.

Freelancers in Czechia: You have four days left to register for the flat-rate tax

The flat-rate system simplifies monthly insurance contributions and removes the need for a tax return—but is it worth it for you?

President Pavel signs law expanding sick pay for self-employed in Czechia

From 2025, people working on a contract basis, self-employed persons, or those in small-scale employment will be able to receive the benefit.

Freelancers beware: Insurance costs set to surge next year

For the first time ever, minimum deposits for social and health insurance contributions will collectively rise by over CZK 1,000.

Freelancers in Czechia: You have two days left to register for the flat-rate tax

We explore how much you'd pay if you opt to sign up for the monthly lump-sum tax payment for the self-employed, which removes the need for a tax return.