Several Czech banks have significantly raised interest rates on euro deposits in recent days in a bid to capitalize on the euro’s recent strength against the Czech crown, Seznam Zprávy reports. This development comes as banks seek to entice both new and existing clients with more attractive savings options.

Among these banks, Creditas has made waves by sharply increasing interest rates on short-term euro deposits. This move is part of a broader trend among financial institutions in the country.

Since the end of August, Creditas has introduced a range of attractive interest rates for euro deposits. While clients previously received a maximum interest rate of 0.6 percent for deposits saved over 10 years, they can now enjoy substantially higher rates over shorter timeframes. Monthly deposits earn savers 2.5 percent per annum, three-month deposits offer 2.7 percent, and half-yearly deposits provide a return of 2.8 percent.

Will euro deposits jump in popularity?

In the Czech Republic, euro deposits make up under 5 percent, although this figure is on a rising trend. In contrast, in Poland and Hungary euro deposits make up 13 percent and 20 percent of all deposits respectively.

CEO of Creditas Bank Eva Collardová says that Czechs have traditionally placed the most trust in their domestic currency, which results in a smaller presence of foreign currencies in domestic bank deposits.

WHAT BANKS OFFER

- Air Bank - 0.1 percent

- Česká spořitelna - 0 percent

- ČSOB - 1 percent

- Komerční Bank - 0.01 percent

- Moneta Money Bank - 2 percent

- Fio Bank - 0.22 percent

- Raiffeisenbank- 2.5 percent

- Creditas Bank - 3 percent

- Trinity Bank - 0.2 percent

- UniCredit Bank - 0.1 percent

- Max Bank - 1.1 percent

- Oberbank - 2.25 percent

- J&T Bank - 4 percent

All figures denote interest per annum on euro deposits

Petr Čajan from the consulting company Premium Financial Services suggests that Creditas may be responding to the Czech National Bank's future rate reductions and its non-interventionist stance toward the crown. In this context, banks are keen to attract or retain clients with secured euro assets due to the fact that the Czech crown will most likely depreciate in the coming months.

On the other hand, Jiří Hluchý from the Frenkee financial portal does not believe that the banks’ new move will alter consumer trends. "I don't think it will affect the behavior of ordinary citizens in the Czech Republic. For a large part of them, the euro is still the currency they think about most in connection with a holiday abroad. We are still in a situation where a large part of Czechs cannot imagine accepting the euro as a currency,” he said.

The gradual increase in euro deposits is supported by Jakub Seidler, chief economist of the Czech Banking Association. Euro deposits have been on the rise over the past two years, particularly among businesses, where the share of euro deposits has reached 21 percent.

For households, the growth in euro deposits is faster, with a total share of 3.3 percent in July this year, up from 2.4 percent two years ago.

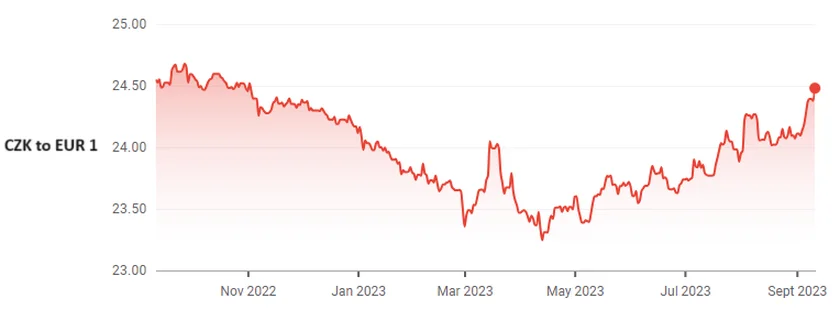

At present, the crown-euro exchange rate is around CZK 24.4 to EUR 1 and is on a gradually deprecating trend. At its 2023 peak (in mid-April), it was at around CZK 23.3 to EUR 1.

Many banks rising interest rates

It's worth noting that Creditas is not the only bank increasing its deposit rates. Raiffeisenbank, for instance, has raised its rates from 0.01 percent per year on all fixed-term euro accounts in May to up to 2.5 percent for a half-year deposit. The bank only requires a minimum deposit of EUR 400 (approximately CZK 10,000) to access these rates.

J&T Bank, catering to wealthier clients, already offered competitive rates in May, with 10- or 5-year time deposits earning an impressive 4 percent per annum. Now, clients can make use of the same rate for deposits lasting one to two years. Shorter-term deposits have seen a one-percentage-point increase, making them more attractive. However, the bank has not observed a significant influx of funds, perhaps due to its high minimum deposit requirement of CZK 1 million.

In contrast, Max Bank introduced a new euro savings account in August, offering a 0.75 percent interest rate, and saw an uptick in client interest. Euro deposits offer a practical advantage by protecting customers from disappointment when traveling abroad with outdated banknotes, which can no longer be exchanged.

ČSOB also reports growing interest in euro deposits for both time deposits and other accounts. Michaela Průchová, a spokesperson for ČSOB, notes that in addition to traditional products, clients are increasingly considering investments in money market funds denominated in euros and dollars. The Czech bank currently offers 1 percent interest on euro deposits per annum.

Czech banks are making significant efforts to attract savers by offering competitive interest rates on euro deposits. While some analysts remain cautious about the immediate impact on client behavior, the trend reflects the evolving financial landscape in Czechia, where euros are gaining importance as a viable savings option.

Reading time: 4 minutes

Reading time: 4 minutes

English

English

Czech

Czech

French

French

Croatian

Croatian

Slovenian

Slovenian

Serbian

Serbian