Mortgages arranged by banks fell just short of CZK 100 billion in the first quarter of this year in the Czech Republic. March alone saw a mortgage volume of CZK 44.723 billion. But rising rates could slow the mortgage market soon, according to Fincentrum Hypoindex.

The average mortgage interest rate rose slightly in March. Compared to February, the average rate rose by one basis point to 1.94 percent per year. Further growth in the average rate can be expected in the coming months in the real estate market.

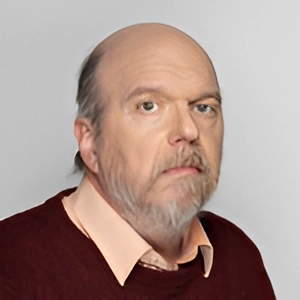

“If we talked about February and January of this year as very successful to record months, then March 2021 is clearly the ‘best’ month in the entire history of Fincentrum Hypoindex. And this applies in all monitored areas,” Jiří Sýkora, product management specialist at Fincentrum & Swiss Life Select, said.

The records include the volume of all provided mortgages for real estate, which reached CZK 44.72 billion, the number of loans at 14,401 units, and average mortgage value of CZK 3,105,568, Sýkora added.

The loan number in March broke November 2016’s record, when banks arranged 14,386 mortgages, by 15 units. This March’s CZK 44.723 volume was also much higher than that of November 2016, which reached CZK 29.683 billion, according to Fincentrum’s figures.

The average mortgage amount increased by CZK 98,667 to CZK 3,105,568 in March alone. This suggests that the upward pressure on property prices is not easing.

In addition, current data from the Czech Statistical Office (ČSÚ) from the construction industry show that not only the number of completed dwellings is declining, but also the number of housing starts, which will be reflected over time in availability of new housing. It can therefore be expected that the pressure on real estate prices will increase, Fincentrum states.

Record setting quarter as well

In the past, a quarter was considered successful when banks managed to negotiate mortgages worth more than CZK 50 billion. The beginning of the year is usually not one of the strongest periods.

However, this year's first quarter deviates from all current trends and, with the volume of agreed mortgages in the amount of CZK 99.578 billion, clearly beat even the strongest first quarter in 2017, when mortgages worth 57.613 billion were agreed on. It also beat the most successful quarter in the history of the Fincentrum Hypoindex, which was the last quarter of last year with a total volume of mortgages of CZK 81.647 billion.

The growing volume trend from last year continues, and will probably only be stopped by higher rates, according to Fincentrum’s analysis. The huge interest in mortgages is probably due to fears of rising interest rates. Therefore, not only those interested in new mortgages to finance real estate went to the banks, but also current clients who decided to refinance their mortgages. The share of refinanced mortgages in some banks reaches up to half of new volumes.

"A large information campaign on how rates are slowly going up has caused people to show a huge interest in a new mortgage, but mainly it caused an interest in refinancing their existing mortgages,” Sýkora said.

“It can be assumed that as rates go up slowly, on the contrary, the numbers and volumes of provided mortgages will slowly decrease,” he added.

Most banks have already raised mortgage rates. During March, rates rose in Air Bank, Equa bank, mBank, Sberbank, the ČSOB Group, and Komerční banka. At the beginning of April, Fio banka raised rates as well. In addition, banks do not rule out further increases in mortgage rates in the coming months due to rising resource prices on the interbank market, Fincentrum stated.

Vladimír Staňura, an advisor to the Czech Banking Association (ČBA), agreed that interest rates will likely rise as costs are passed on. “Already at the beginning of the year, the price of money on the interbank market rose, and in February, according to Czech National Bank (ČNB) statistics, the annual percentage rate of charge for mortgage loans rose negligibly for the first time in eight months,” he told new server Seznamzprazy.cz.

ČNB could get new legal powers

At the end of March, the Chamber of Deputies approved an amendment to the Act on the Czech National Bank. It will give the central bank the legal power to set limits on credit indicators, but it also favors young people under 36. Until now, the ČNB could only make recommendations to banks, but the law would allow the central bank to enforce the limits and, if necessary, in casesof non-complaince, to impose a fine up to CZK 10 million. The amendment to has yet to be approved by the Senate and signed by the president. It could thus be effective in the autumn of this year.

The Fincentrum Hypoindex evaluates the development of mortgage prices over time. It is the weighted average interest rate at which new mortgage loans for individuals are provided in a given calendar month. The input data for the calculations are provided by the following banks: Air Bank, Česká spořitelna, ČSOB, Equa Bank, Moneta Money Bank, Hypoteční banka, Komerční banka, Raiffeisenbank, Sberbank CZ, and UniCredit Bank.

Reading time: 4 minutes

Reading time: 4 minutes