The Pirates would reduce the state deficit by closing tax loopholes and moving sweetened beverages to a higher level of VAT, among other changes.

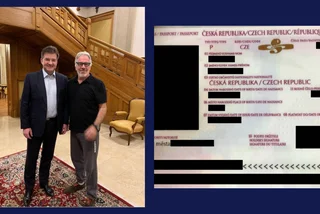

Senator Lukáš Wagenknecht (Pirates) presented the ideas on CNN Prima News in televised debate on how to fix the large budget deficit caused by the coronavirus pandemic.

Most of of the proposed tax reforms were fairly technical, and would close certain exemptions or increase specific taxes on corporations. The increase on tax on sweetened beverages to 21 percent VAT from the current 15 percent is the only one that directly impacts on consumers in general. In the Czech Republic and most of Europe, some 20 to 40 percent of adolescents drink sweetened soft drinks daily; one-fifth of eleven to fifteen-year-olds are overweight and obese.

Taxes or restrictions on sweetened beverages wave been expanding worldwide in an effort ot improve people’s health. Sugary beverages are linked to obesity, which has been a growing problem since the 1970s. People who consume sugary drinks regularly – one to two cans a day or more – have a 26 percent greater risk of developing type 2 diabetes than people who rarely consume such drink, according to the World Health Organization (WHO).

Should the government increase taxes on sugary beverages?

Obesity can also lead to heart disease, which is responsible for 31 percent of all global deaths. A French study published in 2019 in the British Medical Journal found a possible link between the consumption of sugary drinks and a higher or increased risk of developing cancer, though the study did not prove a direct cause and effect.

“Governments can take a number of actions to improve availability and access to healthy foods and have a positive influence on the food people choose to consume. A major action for comprehensive programs aimed at reducing consumption of sugars is taxation of sugary drinks. Just as taxing tobacco helps to reduce tobacco use, taxing sugary drinks can help reduce consumption of sugars,” the WHO states.

Hungary in September 2011 introduced a 4 percent tax on foods and beverages with large quantities of sugar and salt, such as soft drinks, candy, salty snacks, condiments, and fruit jams. As of 2016, the tax had resulted in 19 percent of people reducing their intake of sugary soft drinks and a 22 percent reduction in energy drink consumption.

The UK introduced a tax called the Soft Drinks Industry Levy in April 2018. It as originally estimated the tax would raise GBP 1 billion per year for schools and sports, but actual funds raised have been closer to GBP 240 million per year as of 2019. Many manufacturers reformulated their beverages to avoid taxation.

Other countries to tax sugary beverages include France, Sweden, Portugal, Ireland, Poland, Norway, Mexico, Chile, Peru, South Africa, India, the Philippines, Saudi Arabia, and the United Arab Emirates.

Increases in taxes will be needed to make up for the large budget deficits caused by the coronavirus pandemic. The state budget deficit rose to CZK 192 billion at the end of April from CZK 125.2 billion in March, the Ministry of Finance has stated. It was the worst April result since the establishment of the Czech Republic. Last year, at the end of April, the deficit was CZK 93.8 billion. The state budget deficit of CZK 500 billion has been newly approved for this year. Originally, the budget was approved with a deficit of CZK 320 billion.

The coalition of Pirates/Mayors and Independents (STAN) would win the upcoming Parliamentary elections, scheduled for Oct. 8–9, with 27 percent of the vote, followed by the center-right Together (Spolu) alliance, with 21.5 percent, and the ANO movement with 21 percent, according to the latest Kantar agency poll released by Czech Television.

Reading time: 3 minutes

Reading time: 3 minutes