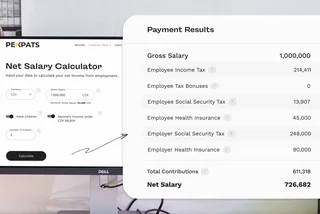

As another year wraps up, early January offers an opportunity to kick off 2026 with a clearer, more confident financial outlook. For expats living in Czechia, this can be especially helpful: multiple currencies, foreign accounts, international subscriptions, and cross-border tax rules often make personal finances more complex than they need to be.

To help simplify the process, we spoke with Jan Stránský, a wealth manager at WOOD & Company, who says that a focused financial review can be helpful when starting a new year on solid footing. Here are the things he recommends keeping in check.

Reset your personal budget for Czech realities

Housing is a sensible place to begin. In some Czech cities and segments, rents have stabilized since the cooling of 2023–24, and according to Stránský, some landlords may be more open to renegotiation than tenants expect.

He also encourages foreigners in Czechia to budget directly in local currency rather than relying on mental conversions from dollars or euros, which often leads to misleading perceptions of affordability.

Building an emergency fund equal to two to three months of Czech expenses is easier now that some local banks, as of late 2025, offer savings accounts with interest rates around 3–5 percent, depending on conditions,” Stránský adds.

If you earn in a foreign currency, Stránský suggests setting an annual foreign-exchange plan, such as converting income at regular intervals to reduce timing risk.

Cancel subscriptions quietly draining your wallet

You signed up for a meditation app months ago, but how often do you really use it? Recurring charges can accumulate quickly, especially when they run in crowns, euros, and dollars. Stránský recommends reviewing the past three months of your bank and credit card statements to identify services you haven’t used in at least six weeks.

After canceling those, consider switching the subscriptions you keep to annual billing if the discount is worthwhile. In Stránský’s experience, he’s seen expats save up to CZK 3,000 per month simply by eliminating forgotten micro-payments.

Review your investment portfolio, especially the Czech side

The Prague Stock Exchange (PSE) delivered nearly 40 percent growth year-to-date in 2025, outperforming many major global markets. Some investors benefited from dividend yields often ranging from 6–10 percent, and defensive sectors provided stability during a volatile global year.

The Prague Stock Exchange remains dominated by dividend-heavy companies in banking, energy, and telecom: something many expats overlook,” Stránský notes.

The financial adviser says that many people underestimate Czechia’s domestic investment potential, assuming better opportunities exist abroad. “With some Czech stocks trading at lower valuations than Western European peers, local equities may deserve a closer look for certain investors,” he says.

Czech-listed companies cited as examples:

- ČEZ (Energy): A major player in Czech energy policy, with proposed nuclear expansion, renewables development, and ongoing debate around restructuring. Dividend policy and regulatory developments are key factors to monitor.

- Komerční banka (Banking): One of the country’s largest banks, generally regarded as stable, with strong capitalization and a history of dividend payments. The Czech National Bank’s interest-rate path is a factor investors often follow.

- Colt CZ Group (Defense): A Czech-based firearms and defense producer that has expanded internationally in recent years, including in North America. Company performance is influenced by acquisitions, export markets, and broader geopolitical developments.

Set achievable financial goals for 2026

“The best financial resolutions are realistic and attainable,” the expert says.

Stránský recommends selecting goals that are clear and trackable. “It’s worth focusing on building assets, such as increasing investments by a specific target or automating monthly contributions like foreign-exchange transfers,” he adds.

According to Stránský, careful preparation and proactive planning can help expats enter 2026 feeling more organized and financially steady.

For a free investment-related consultation, reach Jan Stránský at jan.stransky@wood.cz.

Disclaimer: Investing and trading financial instruments carry risks. Always ensure that you understand these risks before trading.

Reading time: 3 minutes

Reading time: 3 minutes