Americans living in Czechia are navigating rising challenges due to U.S. citizenship renunciation fees and worldwide tax obligations.

Advocacy groups say delays in reducing the renunciation fee, combined with complex reporting requirements, are creating financial and administrative pressure for expatriates.

PARTNER ARTICLE

Renunciation fee is world's highest

A lawsuit filed this week by the Paris-based Association des Américains Accidentels (AAA) challenges the U.S. State Department for delaying a planned reduction of the citizenship renunciation fee. The department announced three years ago it would lower the cost from USD 2,350 (the highest in the world) to USD 450, but the change has not yet been implemented.

The AAA says more than 8,700 people worldwide have paid the full fee since the announcement, generating over USD 20 million. The State Department has not publicly explained the reason for the delay.

Rising global renunciations

Renunciations of U.S. citizenship are increasing sharply, according to a survey by Greenback Expat Taxes. Nearly 5,000 Americans relinquished their citizenship in 2024, a 48 percent increase from 2023, with 2,123 renunciations in Q3 alone, the highest quarterly figure in years.

Globally, the queue for renunciation exceeds 30,000 people, and surveys suggest that 49 percent of expatriates are considering renunciation, up from 30 percent the previous year.

Most renunciations occur in Canada, Switzerland, the UK, Germany, and Hong Kong, according to reports. About 60 percent of inquiries are now related to confusion over tax obligations and citizenship rules.

Advocacy groups note that rising interest in renunciation is also being driven by growing uncertainty about the future of dual citizenship, following the recent introduction of a U.S. Senate bill that would restrict dual nationality. Although this proposal is unlikely to pass, it has heightened anxiety among Americans living abroad.

Accidental Americans in Czechia

Figures from the Ministry of the Interior indicate that there are approximately 10,100 American citizens residing in Czechia, with the majority concentrated in Prague and other urban areas. Many are “accidental Americans,” born in the U.S. but raised abroad.

Our 2025 survey of Americans in Czechia found that 48.7 percent would choose European citizenship over U.S. citizenship if given the option, and 31.6 percent reported frustration with the complexity of U.S. citizenship and tax rules.

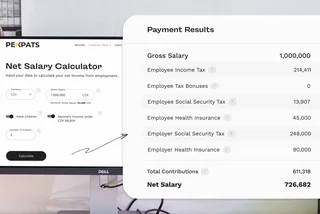

Renouncing citizenship is a costly process, requiring the USD 2,350 fee, potential exit taxes, and five years of certified tax compliance. The U.S. Embassy in Prague manages renunciation appointments; however, rising demand has led to extended wait times.

Low-cost guidance on taxes and citizenship

Until the lawsuit is resolved, Americans in Czechia face steep renunciation costs, extended embassy wait times, and complex reporting requirements, highlighting the growing financial and administrative burden of managing U.S. citizenship from abroad.

In response, Democrats Abroad is offering an eight-week webinar series, launching this month, to help U.S. citizens abroad understand their obligations and manage compliance. The program is practical in focus, aiming to navigate tax and citizenship requirements rather than political issues.

Free sessions include “Demystifying Taxes and Voting for Americans Abroad” on Jan. 21 and “Birthright Citizenship and the Child Tax Credit” on Jan. 28, with additional low-cost sessions covering FBAR reporting, EU investing rules, and other filing requirements. Paid sessions (USD 12.50–USD 15) include recordings within 48 hours.

Reading time: 2 minutes

Reading time: 2 minutes