This year, tax payers in the Czech Republic will spend 169 days working to pay taxes, which is the same amount as last year, according to Deloitte. This means Tax Freedom Day will fall on June 17, 2017.

Tax Freedom Day is a demonstration of the tax burden of a given economy. The method used for calculating it divides the year into two parts, in a ratio corresponding to the proportion of total taxable income to net national income—basically this is the day you stop working for the government and start working for yourself.

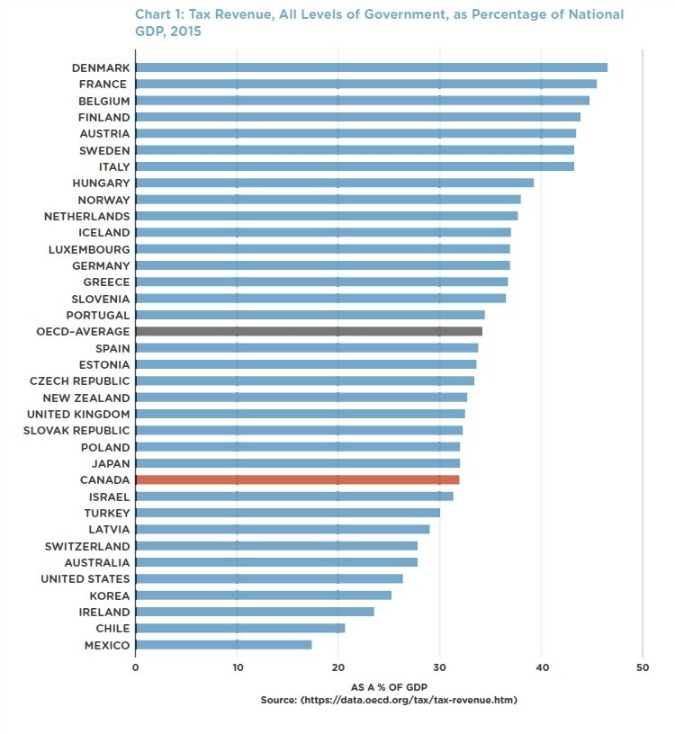

In the EU, the Czech Republic’s Tax Freedom Day is comparable to that of the Netherlands, Portugal, and Germany. Tax payers will have spend the most days paying taxes to the government in Belgium and Luxembourg; while Bulgarians and Romanians spend the least time working for the taxman.

According to Deloitte, this year’s most significant change from the perspective of overall tax collection in the Czech Republic is the extension of the electronic sales records.

<br/ >Infographic: OECD

<br/ >Infographic: OECD

Compared to last year, the tax relief limit for placing a child in a nursery school or a similar facility has also increased.

“The increased minimal salary will result in an increase in the lower limit of income for the entitlement to a tax bonus to arise. Given the increased minimal salary, the aggregate amount of exempt pensions has also been automatically adjusted,” says David Marek, Deloitte’s Chief Economist.

The Deloitte figures stand in contrast to calculations done by Czech think-tank the Liberal Institute whose Tax Freedom Day (Den daňové svobody) fell on May 29, of this year, meaning that, according to their data, those in the Czech Republic, spent 149 days working for the state, four less than last year.

That number is derived from a different set of methodology which factors in not just revenues but expenditures.

Reading time: 1 minute

Reading time: 1 minute