The average mortgage rate rose for the eighth month in a row but the number of people interested in a mortgage has not decreased. The volume of mortgages provided in October again exceeded CZK 30 billion, according to Fincentrum Hypoindex. Mortgage interest rates are expected to rise still further, perhaps approaching the 5 percent mark next year due to inflation and lending rate changes by the Czech National Bank (ČNB).

The average interest rate on mortgages rose by a further 11 basis points to 2.54 percent per year in October. Since March this year, the average interest rate on Czech mortgages has risen by 0.61 percentage points.

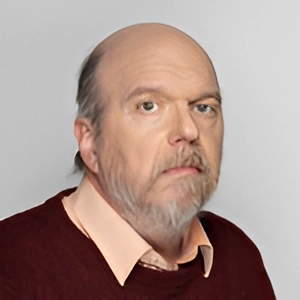

“October is the eighth month in a row that the average interest rate has risen. So far, it has stopped at 2.54 percent. Following a sharp increase in interest rates by the ČNB, individual banks are also raising their bid rates,” said Jiří Sýkora, a mortgage analyst at Fincentrum & Swiss Life Select.

At the start of October, the ČNB increased the base rate by 0.75 percent to 1.5 percent, due to rising inflation. This increase has yet to be reflected in mortgage rates. There was another even sharper increase of 1.25 percent at the start of November, bringing the base rate to 2.75 percent.

Fincentrum Hypoindex figures have a delay of about two months, as the index records the rates of mortgages actually provided. It takes banks about two months to process mortgage loans.

“These bank increases have not yet been reflected in this index. However, it is clear that rates will gradually rise and reach over 4 percent, and it is likely that they will hit 5 percent [next year],” Sýkora said.

Some banks have already crossed the 4 percent threshold for certain mortgages issued this month, Fincentrum stated.

In October, banks arranged 10,065 mortgages in a total amount of CZK 32.069 billion. Some 463 more people sought a mortgage than in September, and the year-on-year increase was 1,265 applicants. The volume of provided mortgages increased by almost CZK 1.5 billion compared to September, and compared to October 2020, the volume increased by CZK 6.9 billion, according to Fincentrum Hypoindex data.

Still, the year-on-year rise in the volume of new mortgages is starting to slow down compared to previous months. In August the year-on-year increase in mortgage volume was more than 75 percent, but in September it was 38 percent, and in October it was only 27 percent.

"A gradual increase in rates will result in a gradual decline in the number of applicants seeking new loans,” Sýkora said.

"In October, however, the volume of provided loans reached a total value of CZK 32.069 billion, which is even more than in September. However, it can be assumed that as soon as the jump in prices is reflected in the average rate, the volume of signed mortgages will also fall sharply,” Sýkora said.

From January to October this year, banks arranged mortgages worth a total of more than CZK 355 billion. Even if there is a sharp decline in applications for mortgages, the volume of mortgages provided this year could reach CZK 400 billion, according to Fincentrum’s analysis.

The average mortgage loan amount in October rose to CZK 3,186,238. Compared to September, when the average mortgage fell by CZK 45,913, there was only a minimal increase of CZK 2,420.

Fincentrum Hypoindex evaluates the development of mortgage prices over time. It finds a weighted average interest rate at which new mortgage loans for individuals are provided in a given calendar month. Input data for the calculations are provided by Air Bank, Česká spořitelna, ČSOB, Equa Bank, Moneta Money Bank, Hypoteční banka, Komerční banka, Raiffeisenbank, Sberbank CZ, and UniCredit Bank.

Reading time: 3 minutes

Reading time: 3 minutes