Self-employed people in Czechia have two days left – until Jan. 10 – to apply to pay the lump-sum monthly flat-rate tax for the 2024 financial year. This removes the need to pay an annual tax return, instead grouping income-tax, and health and social insurance contributions into one monthly payment. This is an optional move.

This year, there are several changes to the flat-rate tax, including the payment amount, new bands of payers (based on income), and the method of paying for it.

PARTNER ARTICLE

A flat-rate tax is, in short, a single payment for all business-related levies. It includes advances for social and health insurance and income tax.

In 2023, there was only one band for payers of the flat-rate tax – the option was solely available to those with annual incomes of up to CZK 1 million. However, this year there are three: those who earn up to CZK 1 million per year, people with annual incomes of between CZK 1 million and CZK 1.5 million, and those who earn between CZK 1.5 million and CZK 2 million annually.

If you pay value-added tax (VAT) on behalf of yourself or your business, are a partner of a publicly traded company, or appear in an insolvency register, you cannot join the flat-rate tax.

How much might I pay per month?

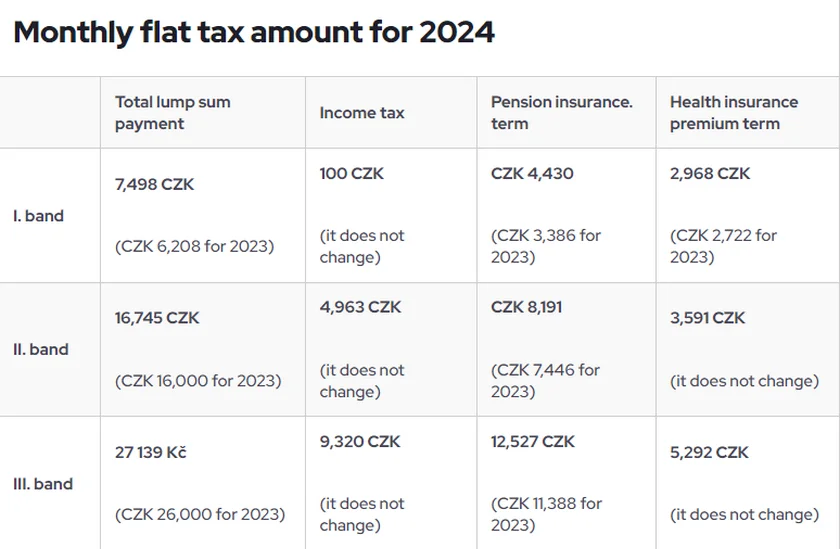

Those who are in the first band of the flat-rate tax will in 2024 pay a set CZK 7,498 monthly, up from CZK 6,208 in 2023. This year, CZK 4,430 will go towards social insurance, CZK 2,968 towards health, and CZK 100 for personal income tax. This translates to an annual payment of almost CZK 90,000 per year.

The table below shows exactly how much the second and third bands will pay monthly in 2024, also using 2023 figures for reference.

Is the flat-rate tax for me?

Whether or not you believe the flat-rate tax is for you depends on your priorities. By far the biggest advantage of the lump-sum monthly payment is its simplicity and elimination of the need to file a tax return, which can often be a confusing task. It also ensures that you won’t pay any additional taxes or insurance premiums.

The flat-rate tax also means that many small businesses and individuals will end up paying less income tax than they would if they needed to file a tax return. Assuming they are placed in the first band of payers for the flat-rate tax, they would pay only CZK 1,200 in income tax per year.

There are downsides to the added convenience, though. Because you won’t be able to submit a tax return, you will not be able to apply for tax discounts and deductions. This includes mortgage-interest, and life and pension insurance deductibles.

It is also worth pointing out that many banks require a tax return when applying for a loan or mortgage. Signing up for the flat-rate regime will make proving your income more cumbersome.

Lastly, under the flat-rate regime (in the first band of payers), monthly social insurance payments are almost CZK 600 more expensive every month compared to the rate you’d pay if you were paying social insurance independently every month for the first time.

Financial-advice website Finmag.cz writes that, aside from people who wish to avoid administrative and calculation-based stress, the flat-rate tax generally benefits those with higher incomes and those with not many tax credits, deductibles, or exemptions.

How do I sign up for it?

Those who used the 2023 flat-rate tax will automatically be assigned it again (based on last year’s annual income, unless it has changed significantly), unless they opt out.

Calculate whether you'd benefit from the flat-rate tax by using this comprehensive calculator from Finmag.

Self-employed people with data boxes must apply for the flat-rate tax electronically. They must then declare their income and choose the relevant band they will pay. Those with no data box created, regardless of the reason, can download the official application form online and submit it to their nearest tax office. Both online and offline applications must be done before Jan. 10.

The flat-rate tax advance payment is due by the 20th day of every calendar month.

Reading time: 3 minutes

Reading time: 3 minutes