Now more than ever, people living in the Czech Republic are wondering how they can make their money grow. Even with interest rates going up, money kept in the bank has no chance of keeping up with inflation, which has been at over 15 percent for the past six months.

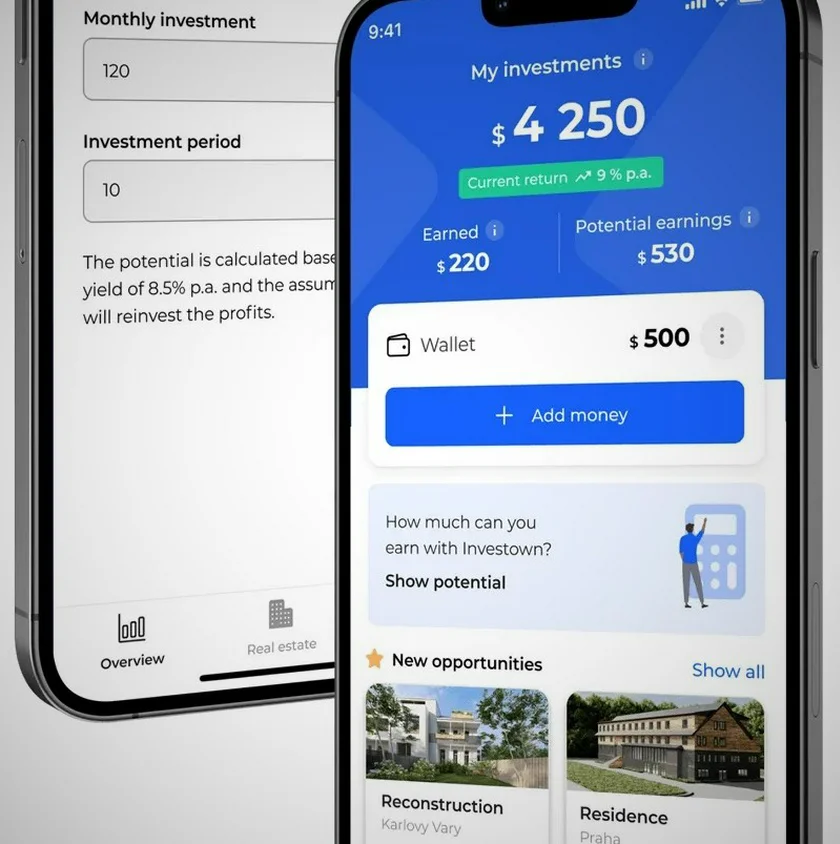

Step forward Investown, a Czech crowdfunding platform giving everyone the chance to invest in loans backed by real estate. Unlike real estate investment trusts or other real estate development investment opportunities, Investown is open to ordinary people who don’t have hundreds of thousands of crowns set aside; users can start investing online with as little as CZK 500.

Investing for everyone

Having launched a year and a half ago, Investown has already enjoyed remarkable success. It’s now home to around 60,000 investors, who have together contributed over CZK 750 million to crowdfunded projects. The only requirement is that they have a Czech bank account, though even this rule could be removed as the company looks to expand beyond the Czech Republic.

Peter Maslik, Chief Operating Officer and co-founder at Investown, says Investown was built by seasoned professionals who know the local fintech scene inside-out.

“We’ve managed to put together a formidable team of experts in their respective fields,” Maslik, who has previous experience from a London-based fintech firm, said.

“Investown is based on a proven concept. Yet the crowdfunding model has, until now, only really taken off in the U.S., where people are more used to the idea of investing. For example, 55 percent of the American population invests, but only 9 percent of Czechs. People in this region tend to be more savings oriented, and they’re often skeptical of investment because of all the different scams when the stock market opened up after socialism,” according to Maslik.

But building up Czechs’ trust in investing is only possible by providing positive experiences. To this end, Investown aims to make it possible for everyone to invest in an environment with minimal risks, opening up opportunities for people with lower disposable incomes.

“You don’t need to have millions saved up. Everyone can take part; even people who just have CZK 10,000 left at the end of the month. They can get started with CZK 2,000 or CZK 3,000 and watch their money grow,” says Maslik.

Opportunities in real estate

Investown’s democratic platform allows people of all income brackets to invest in real estate developments, which remain among Czechia’s most reliable and highest-yielding investment categories. Crowdfunding allows Investown to raise the same amounts of money as more traditional investing institutions, but the benefits accrue to hundreds or even thousands of people, rather than a select few.

“Real estate investing is, in many ways, the pinnacle of investing. Traditionally, it means buying an apartment, renting it out, and then buying another, and so on. We wanted to take that mentality and apply it in our platform. You can put CZK 5,000 into an apartment, or with more investors you can take part in major development projects costing CZK 70-120 million. Investown unlocks a range of opportunities for everyone,” said Maslik.

While an economic downturn looms as a result of global turmoil, real estate is still a safe haven for investors. And security for your money is further ensured by Investown’s partnership with Česká spořitelna, Czechia’s largest commercial bank.

Indeed, Maslik says the real estate market still “has a lot of potential to grow” over the coming period, and that even if the boom in house prices does start to slow down, it will be “years from now, based on our own analysis as well as studies from other industry experts and consultants.”

And unlike investment trends such as cryptocurrencies, real estate provides a tangible asset which is, by nature, less vulnerable to dramatic changes in value. As its platform grows, Investown is taking on larger real estate projects, including the purchase of entire apartment buildings, and the conversion of an old hotel in the Beskydy mountains into a living complex.

Who’s already investing?

A look at the socio-economic demographics of Investown users confirms that it really is a platform for everyone.

“Users include people fresh out of university who are keen to try something new, people in their early thirties with stable jobs and savings set aside, pensioners, as well as experienced investors with millions of crowns who turn to us to help diversify their investment portfolio,” said Maslik.

And while some crowdfunding platforms focus on attracting larger investors, Maslik says “for now, we refuse to raise the minimum CZK 500 investment, because we believe everyone should be able to access the platform.”

The diversity of Investown users will expand still further once the company expands into new markets next year. And whoever you are, Investown wants to make investing possible wherever you go. Enhancing the company’s mobile app is another priority which will drive even more money-making opportunities in future.

As Maslik says, crowdfunding may well be “the future of investing.” Even in this innovative field, Investown is unique for its democratic approach. By making it possible to invest with small amounts of money, the company is helping everyone to get involved in profit-making projects, bringing the benefits of investment expertise to the general public.

Disclaimer: Trading financial instruments carries risks. Always ensure that you understand these risks before trading.

Reading time: 4 minutes

Reading time: 4 minutes