When it comes to finding the right place to invest your money, the advice of experts is now more crucial than ever.

There’s a host of investment companies out there, with opportunities open to everyone from large-scale institutional investors to people with just a few hundred crowns to spare. But to achieve the best possible gains and the maximum security for your money, those with the funds to do so would find it advisable to opt for opportunities offered by one of the established leaders in Czech investments.

Wood & Company is a Czech company with a three-decade history and a focus on helping foreigners grow their money. It was founded in 1991 by British financiers Richard Wood and Alexander Angell, and from humble beginnings it has grown to become one of the country’s most well-respected investment banks.

Wood & Co. is pushing the boundaries of investing in Czechia with exciting new products, while also providing extremely attractive traditional options including real estate funds and bond opportunities. Each client gets a personalized investing experience with their interests and ethics always coming first.

Unique opportunities

While WOOD & Company offers access to many investments typically associated with any investment bank, it also provides investment opportunities only available through Wood & Co., meaning they’re not open to investment in the wider market. This gives clients one-of-a-kind access to some of the region’s most profitable projects.

These include two separate office and retail real estate funds, which form Wood & Co.’s flagship offers to investors. Impressive 8-10 percent annual returns are targeted, with a recommended minimum five-year time horizon and a minimum initial investment of EUR 40,000, or the equivalent of CZK 1 million if approved by the fund’s administrator.

These real estate funds are an effective tool for fighting inflation. Impressive performance in 2022 meant some clients were even able to outperform inflation, a claim not many other investment funds can match. 2022 was a record year; Wood & Co.’s office sub-fund recorded a return of 14.35 percent, while the retail sub-fund saw an incredible 21.07 percent return in CZK.

According to Jan Stránský, Sales Manager at Wood & Co., each investor is treated individually and should not hesitate to start a conversation about these attractive funds.

“Wood & Co. has acquired many clients over our 30+ years on the Czech market. But we aren’t a large corporation whose clients are just numbers. Each and every client works on a one-on-one basis with a designated relationship manager. We get to know our clients on a professional and a personal level, as this brings an even deeper significance to clients’ financial performance,” Stránský explains.

As well as high-performing real estate funds, Wood & Co. also offers bond investments which offer even greater security while still providing attractive fixed returns. Bonds tend to have natural risk diversification due to the wide scope of projects which they fund, mitigating many of the external risks typically faced by real estate developers.

Bonds also offer the chance to invest in climate-friendly projects, ensuring that your returns are not only respectable but also sustainable. Wood & Co.’s personalized approach means clients can invest in what they believe in.

“Clients can contact their relationship manager around the clock or meet in-person. They’re also given access to our online portal, allowing them to track the current status of their investments,” Stránský says.

Breaking investment barriers

In 2022, Wood & Co. achieved a new milestone by launching the first Special Purpose Acquisition Company (SPAC) in Central Europe. A SPAC is an investment instrument which accelerates the way in which a privately-owned company becomes listed on the stock exchange and raises capital to fund its development plans.

“The route to an initial public offering (IPO) using a SPAC can take just a few months, whereas a conventional IPO process can take more than a year,” says Stránský. “A SPAC is like a large bundle of cash which is listed on the stock exchange, backed by the name of its sponsor (in this case, Wood & Co.), with no actual company for investors to react to based on performance. A private company merges with the SPAC, taking that company public, saving it time and money.” Stránský further describes the SPAC as a kind of “speed dating” for companies seeking funding.

Investment in WOOD SPAC One is still possible, though the primary phase of investment has now passed. Wood & Co. selected the promising streetwear brand Footshop to take public. Stránský says Wood & Co. hopes to launch another SPAC in future.

Investments for expats

Expats may find it hard to navigate the Czech investment environment, and it can be tempting for them to prefer investing in their home countries. But according to Stránský, they’re more likely to enjoy success investing in the country where they actually live.

“I would strongly recommend that anyone who lives here, or who plans on being in the Czech Republic long-term, considers investing here. Expats earn in Czech crowns and pay their day-to-day expenses in crowns. It’s more effective for them to get their returns in the same currency, as opposed to losing a portion on exchange rates and fees,” he says.

Wood & Co. also has the advantage of Sales Managers who speak fluent English, and many of them have personal experience dealing with situations faced by expat investors. Stránský is an example: he is a Czech-American who was born in the U.S. and is a native English speaker. Expat investors will therefore find a level of understanding, communication, comfort, and even friendship with Wood & Co.’s representatives that they won’t find elsewhere.

What’s more, Stránský points out, Czechia is an attractive investing environment in its own right.

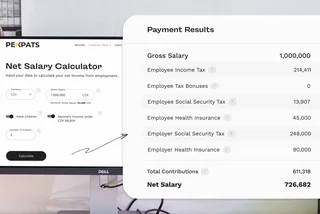

“You don’t have to pay taxes in Czechia on investments held for three years or longer. Another major benefit of investing here is that our market is smaller and less saturated than, for example, that of the U.S. and other large global markets. This means it’s much easier for investors to sift through opportunities and make sense of their options, ultimately making the financial decisions that work best for them.”

Should you be interested in working with Jan Stránský and WOOD & Company, he can be contacted by email at jan.stransky@wood.cz.

This article was written in cooperation with WOOD & Company. Read more about our partner content policies here. Disclaimer: Trading financial instruments carries risks. Always ensure that you understand these risks before trading.

Reading time: 5 minutes

Reading time: 5 minutes