This article was written in cooperation with our partners at Czech Taxes Online. Read more about our partner content policy here. Bonus: save 10% when filing your taxes by using the promo code at the end of this article.

It’s officially tax filing season in the Czech Republic, and all individuals who have earned income in the country are required to submit an income tax return by March 31, 2019.

The process of submitting a tax return in the Czech Republic can be a complicated one, especially if you don’t speak Czech.

But there is help readily available: certified accountants such as Expat Taxes specialize in assisting non-native speakers, and will typically charge a relatively small fee to process income tax documents.

And if you’re up for a little form-filling yourself, the process can be even easier. And less expensive.

Czech Taxes Online, set up by the same certified accountants that run Expat Taxes, allows users to enter all their relevant tax information online and generate an official Czech tax return – all for the reasonable price of 500 crowns (and that price can be 10% less if you use the discount code at the end of this article).

Having typically paid an accountant multiple times that figure over the past two decades years, I decided to give Czech Taxes Online a spin this year – – and came away surprised at how painless the process can be.

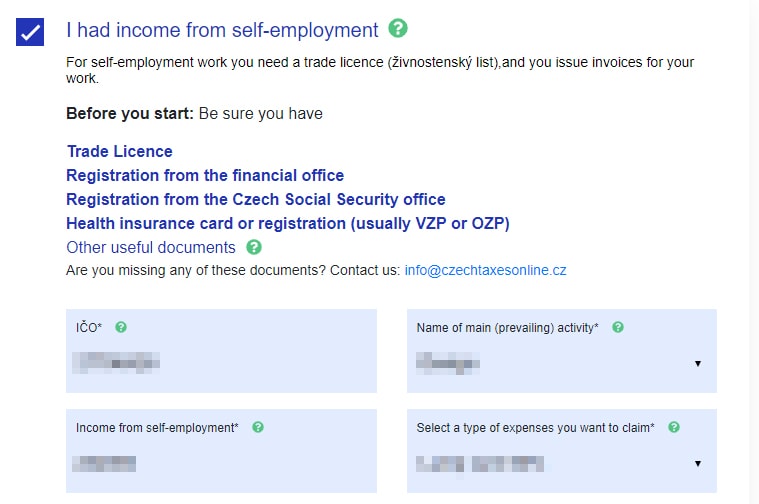

After registering with the website, I was sent to a short form that included some basic information. Because I work from a trade license (živnostenský list), I was reminded to have some relevant documents including health insurance and social security registration info handy.

What followed was a brief questionnaire that included all relevant tax info – marital and parent status, donations, etc. – gross income and relevant registration numbers. If any field is at all unclear, the site provides help text to explain in detail.

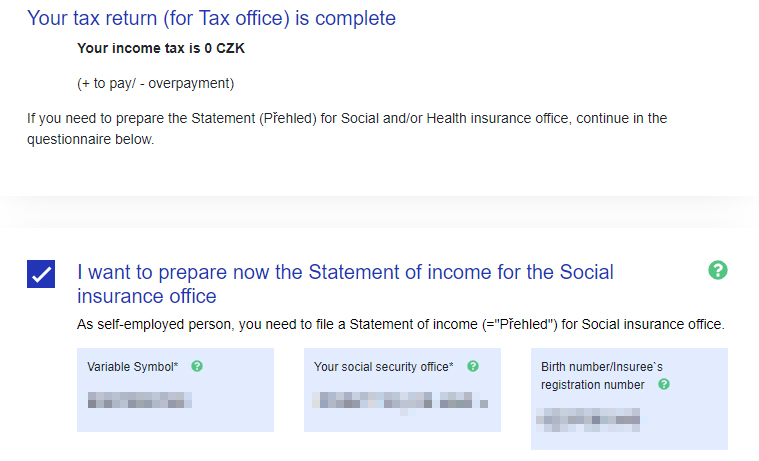

In less than 15 minutes, I had an official tax return ready to be printed and submitted to the tax authority. If you don’t have a printer, you can request a copy of the tax return to be mailed to you for an additional 100 crowns.

Czech Taxes Online can also create a statement of income to submit to social security and health insurance authorities for no additional cost, though this step is optional.

If you’ve never filed taxes in the Czech Republic before, you can try Czech Taxes Online for free to get an idea of how the process works. The 500 crown fee is only required to receive a PDF version of your tax return along with instructions on what to do with it next.

No knowledge of Czech is needed to prepare the tax return, as the interface is fully available in English (as well as Czech). All calculations using the online form are verified by certified accountants.

Remember: the deadline for submitting a tax return in the Czech Republic is March 31, 2019. Additionally, documents for social security and health insurance (if applicable) need to be sent by April 30, 2019 at the latest.

If you’d like to try Czech Taxes Online for yourself, be sure to use to promo code CT1F8B at checkout to receive a 10% discount on your order, turning the process of filing a Czech tax return into a painless 450 crown expense.

Reading time: 2 minutes

Reading time: 2 minutes