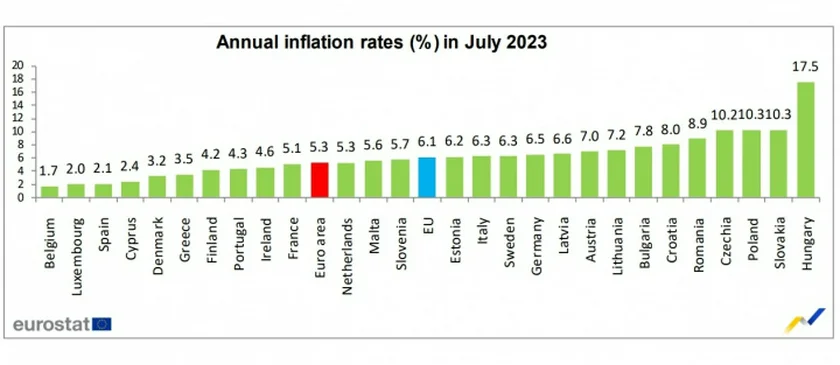

The Czech Republic recorded a significant one-percentage-point drop in inflation to 10.2 percent in July, according to the latest data on inflation across the EU provided by Eurostat. However, the country still ranks fourth among the EU nations with the highest inflation rates.

In July, the European Union as a whole saw a moderate drop in its year-on-year inflation rate, which slowed down from 6.4 to 6.1 percent according to the Eurostat data. Similarly, the eurozone's inflation declined slightly from 5.5 to 5.3 percent.

PARTNER ARTICLE

Competitively, inflation rates last summer were driven to historic highs due to an unprecedented surge in energy prices, pushing the EU's inflation to a staggering 9.8 percent, with the eurozone just under nine percent.

Among EU nations, Belgium had the lowest year-on-year inflation, at a modest 1.7 percent. Luxembourg and Spain followed with 2 and 2.1 percent, respectively.

Inflation in the Czech Republic, meanwhile, remains above ten percent and among the highest rates in the EU. Only Hungary, which saw its inflation rate soar to 17.5 percent last month, along with Czech neighbors Slovakia and Poland (both at 10.3 percent) saw July inflation rates higher than Czechia.

In a month-on-month analysis, consumer prices in the EU remained stagnant in July, while the eurozone experienced a marginal 0.1 percent decline. Inflation rates in 19 countries slowed in a month-on-month comparison, while they rose in seven others and remained unchanged in Sweden.

In light of these figures across the eurozone, the European Central Bank faces a challenge of persistently high inflation, exceeding its two percent price stability ceiling. Despite the recent easing, eurozone inflation continues to surpass the bank's targets.

The bank's response to this challenge has been incremental interest rate hikes over the past year, with July witnessing the ninth consecutive rate increase. The most recent hike involved a quarter-percentage-point rise, bringing the base interest rate to 4.25 percent.

Like the eurozone countries, the Czech Republic has maintained a similar strategy in attempts to curb inflation. At its most recent meeting in June, the Banking Council of the Czech National Bank confirmed to keep its base interest rate at 7 percent.

In light of the high interest rates, borrowing becomes more expensive and people are more likely to save. A higher base interest rate can also attract foreign investors who seek higher returns on their investments.

Reading time: 2 minutes

Reading time: 2 minutes