Investment isn’t rocket science. At the same time, the greater an investor’s expertise, the more likely they are to identify projects providing high returns and minimal risk. Investing is now more accessible to the general public than ever before; but with so many possibilities out there, non-experts can find it hard to know where to begin.

Online platforms for crowdfunded investments are providing a solution for this new environment. They can offer opportunities that are democratic in their availability to small-scale investors, but carefully analyzed and managed by leading lights of the local investment scene.

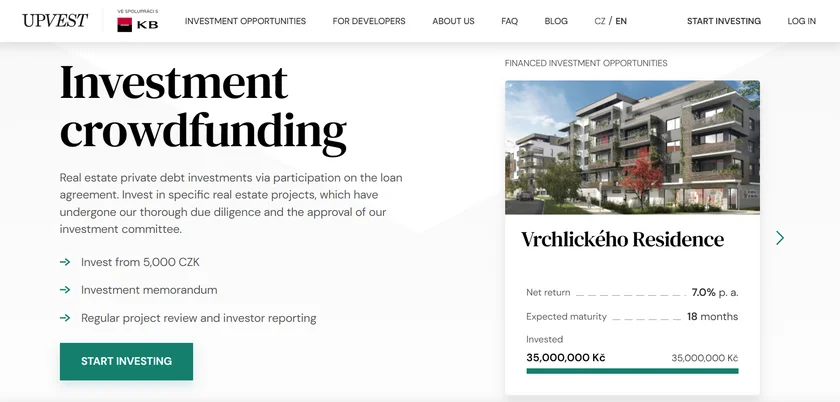

Leading this new wave is Czech real estate investment platform Upvest. The company’s analysts identify viable development opportunities through a stringent assessment process passed by only one in ten potential projects. They then start crowdfunding for investments, using a system of real estate private debt purchasing.

Here are five reasons to put your money in the hands of experts amid vast investment opportunities in the Czech Republic.

Real estate private debt

Real estate developments have long been among the most desirable investment opportunities because of their relative security. Real estate is not often subject to the same dramatic value fluctuations as company stocks; while the purchasing of private debt means investors working with Upvest benefit from more reliable payment schedules as well as greater protection for their investments.

Upvest’s model also means smaller “retail” investors can rub shoulders with “institutional” investors putting large sums of money into the selected projects. The minimum investment through Upvest is CZK 5,000, but an average investment is CZK 94,000 and many of the platform's clients invest CZK 1 million or more, gaining annual returns of 4-9 percent depending on their chosen project.

“We use a crowdfunding model and an online investment platform to distribute participation in professionally structured real estate private debt. Thanks to our technology and the crowdfunding sales model, we can offer investments not only to high-net-worth clients, but also to retail investors,” said Petr Volný, Chief Technology Officer at Upvest.

Picking the right opportunities

One of the primary benefits of choosing Upvest for retail and institutional investors alike is the security that comes with a team of industry-leading professionals. Key to the platform’s approach is its clear communication of the risks of a given investment, making sure investors join projects with their eyes wide open. In the current volatile economic climate, such transparency can provide much-needed peace of mind.

Since its launch in 2017, Upvest has not experienced any problems with repaying investors. The default rate for invested loans remains 0 percent, and 12 projects have already been successfully completed with loans repaid.

“No matter the situation on the market, our goal will always be to control the downside risks from the perspective of the lender,” says Volný. “Our product, the real estate private debt, is feasible for any situation on the market. It just needs to be properly adjusted over time.”

Peace of mind

Another key consideration for potential investors is the credibility and reliability of a given investment platform. Upvest lenders can rest easy on this score, because the company is co-owned by Komerční banka, the third largest banking group in the Czech Republic by both number of clients and volume of money managed. KB became a co-owner of Upvest in 2020, subsequently choosing to increase its stake to 31.06 per cent.

Transparency

So far a total of nearly CZK 1 billion has been invested through Upvest. Opportunities can range from a crowdfunding target of CZK 5 million to CZK 100 million or more. Each project offers a different net yield and expected debt maturity, all communicated clearly through the online platform.

The website even displays how many investors have already chosen to get involved with a given project; indicating levels of excitement about a project, as well as the scale of investments being made. This is all part of Upvest’s emphasis on honesty; the company aims to educate and inform investors, rather than simply persuading them to part with their money.

Detailed information about each opportunity is provided, including specifications of the planned development, the developer undertaking the project, and the credentials of the Upvest investment manager in charge of the crowdfunding sale. Potential investors are strongly encouraged to read through all the provided information to make sure the opportunity they select is right for them. Those who make an investment receive regular email updates about the progress of their chosen project throughout its duration.

Opening up investment to expats

Upvest is English-friendly and welcomes investments from non-Czech speakers. The platform is hoping to attract more interest from the Czech Republic’s international community going forward.

“We recently finished translating the main parts of our app to English, with expats in mind. If we see significant interest from English-speaking investors, we will enhance the internationalization of the platform still further,” said Volný.

The new era of investment in the Czech Republic is one of greater accessibility and greater opportunity. But there’s no question that the huge level of available information makes the guiding influence of seasoned experts more vital than ever. Upvest’s experienced team and carefully selected opportunities open up the best of Czech investment for small and large investors alike.

Reading time: 4 minutes

Reading time: 4 minutes