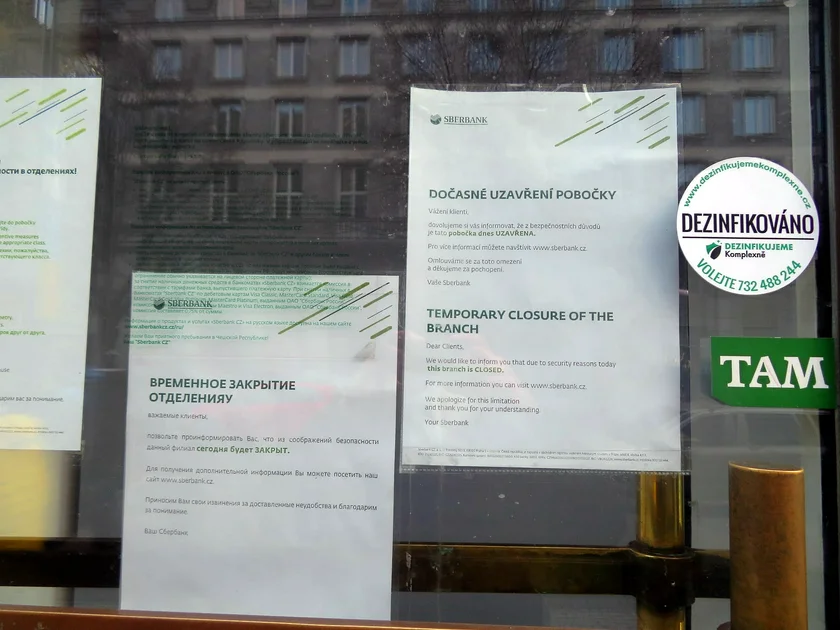

Czech bank Česká spořitelna is set to take over defunct Sberbank CZ’s loan portfolio. The Czech division of Russia’s Sberbank banking license was revoked by the Czech National Bank at the end of April, and the Czech company operating Sberbank was declared bankrupt by a Prague court in August.

Sberbank CZ insolvency administrator Jiřina Lužová has signed a preliminary agreement with Česká spořitelna concerning the purchase of a CZK 47.1 billion loan portfolio from Sberbank CZ. The purchase price is CZK 41.05 billion.

If the sale is settled by the first half of 2023, creditors’ claims against Sberbank CZ could be paid via a partial schedule starting in the second half of 2023, the Czech News Agency (ČTK) reported.

The signing of the contract doesn’t change anything for the Sberbank CZ credit clients. Until the sale is finalized, they still have to meet their obligations as before.

Lužová told ČTK that Česká spořitelna's offer together with the available cash and the expected proceeds from the sale of other Sberbank CZ assets should be sufficient to satisfy the Financial Market Guarantee System, natural persons, and small and medium-sized enterprises. It is also likely that over 90 percent of the claims coming from regions, cities, municipalities, and large companies will be met.

Willi Cernko, head of Austria’s Erste Group, which owns Česká spořitelna, told ČTK that if the regulatory authorities approve this transaction, Erste Group will be able to continue to expand Česká spořitelna's position in the Czech market.

"Like last year's purchase of Commerzbank's corporate client business in Hungary, this transaction is an example of how targeted acquisitions support the organic growth of Erste Group," he added.

Čs needs to jump through several hoops before concluding the contract

The signed contract still needs to be approved by the Czech National Bank and the Office for the Protection of Economic Competition. A prerequisite for its completion is the granting of another exemption from U.S. sanctions against doing business with Russia, as the current exemption expires on Dec. 12.

Other potential stumbling blocks to the sale, according to Lužová, include legal challenges. The sale might not be completed if legal proceedings are conducted on the appeals that some of the creditors filed against the appointment of the creditors’ committee or if the relevant agreement on the sale of the loan portfolio is challenged by creditors' lawsuits.

Lužová said the Sberbank CZ insolvency is one of the largest in Czech history, both in terms of financial volume and the number of creditors.

“That is why I am very happy that we managed to achieve this extraordinary result in a very short time. I would like to highly appreciate the responsible and professional approach on the part of Czech savings banks and also the support of a proper creditors' committee,” Lužová said.

More sales of Sberbank assets to come

She said she plans to offer the rest of the loan portfolio and other Sberbank CZ assets that are not part of the preliminary contract to other banks and non-banking companies at the beginning of 2023.

Sberbank CZ’s most valuable asset is its portfolio of over 43,000 loans. The bank has about 3,800 borrowers from legal entities and 31,500 borrowers from natural persons, of which 13,300 are borrowers from mortgage loans, according to ČTK.

Reading time: 2 minutes

Reading time: 2 minutes